Bitcoin Lightning Network

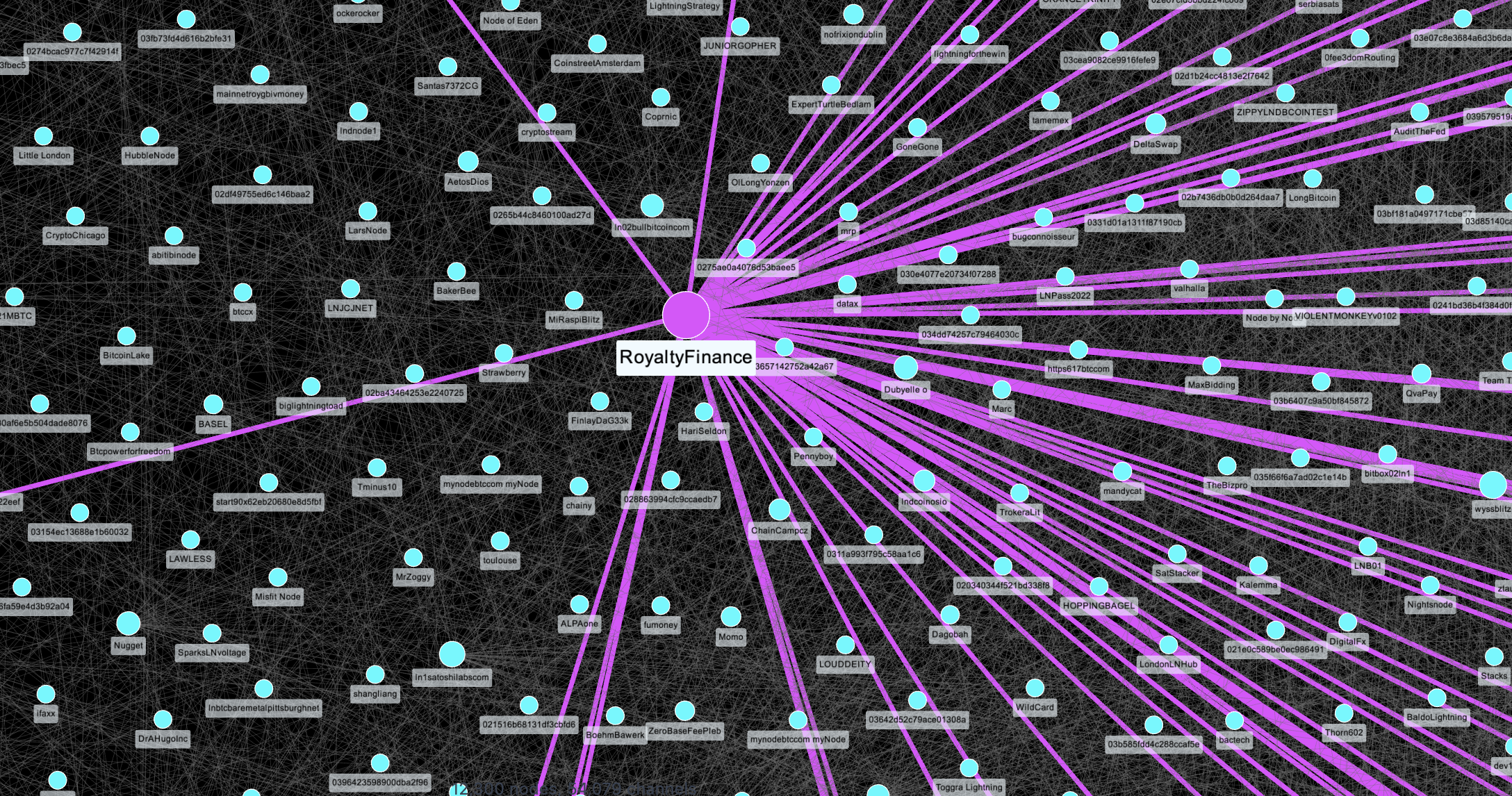

We support the decentralisation of lightning network by operating our own Bitcoin node to forward payments and lease Bitcoin to merchant channels for liquidity

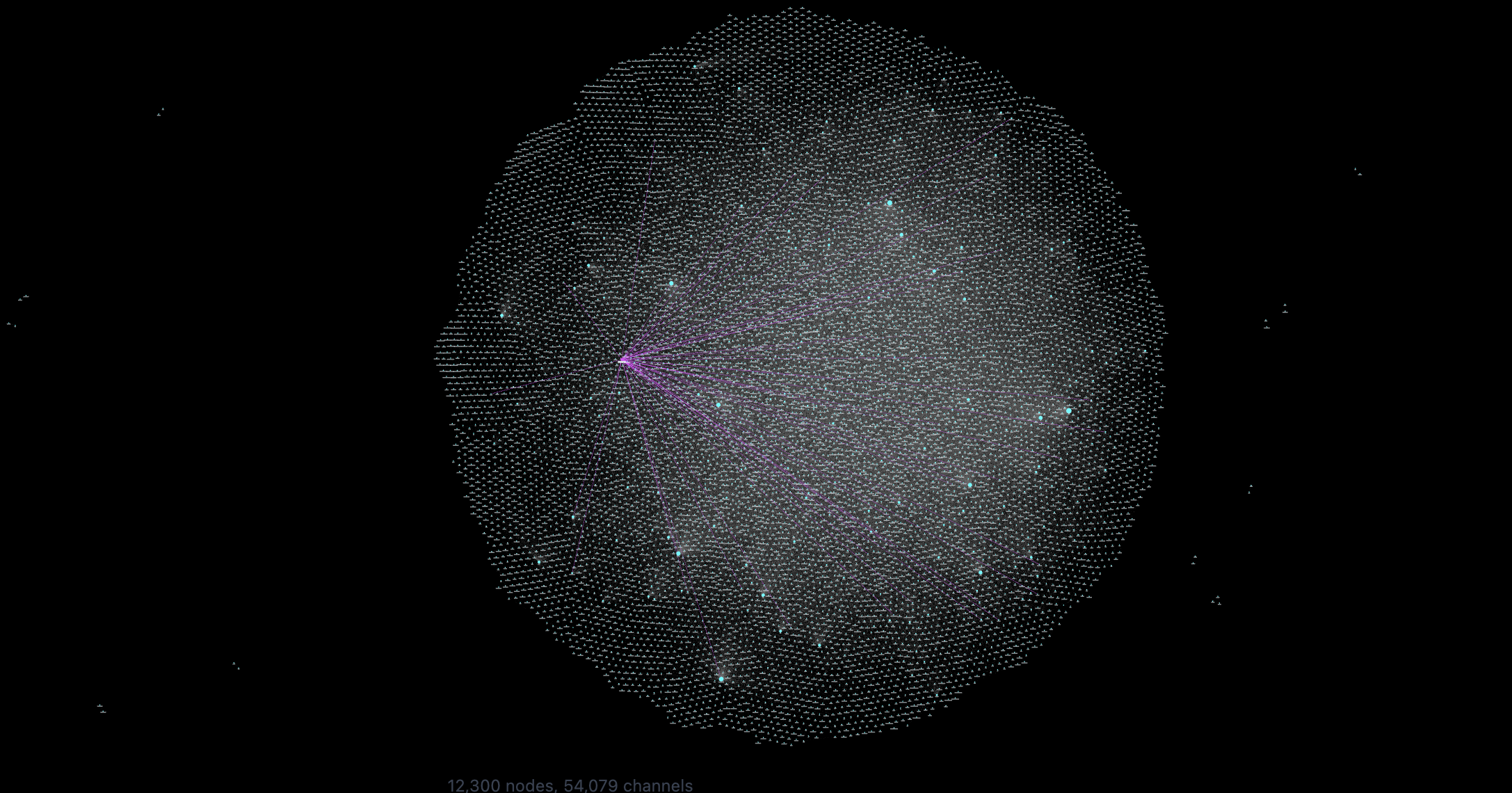

Lightning is a decentralized network using smart contract functionality in the blockchain to enable instant payments across a network of participants.

Scalable

Instant Transactions

Low Cost

Node generates royalties by routing payments and providing liquidity to new channels with merchants.

Forwarding Payments

Selling Liquidity

Node Administration

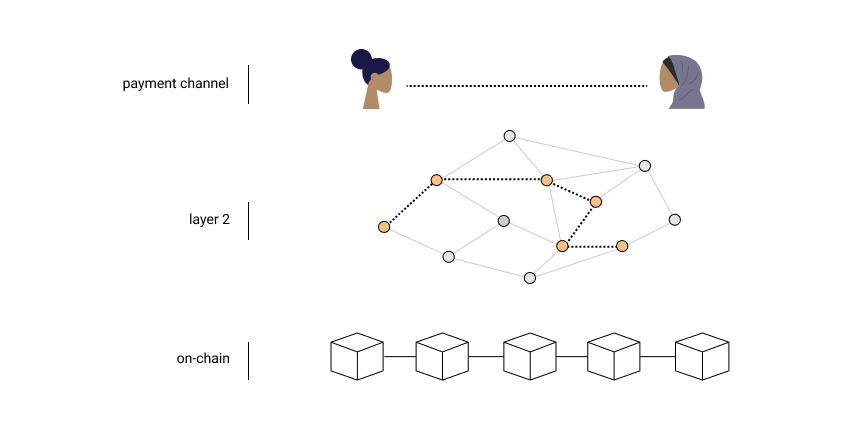

The network of nodes creates peer-to-peer payment channels. A simple channel is between two parties such as a paying customer and a receiving merchant. Once a channel is open, it enables them to make an unlimited amount of transactions that are nearly instant and low cost compared to on-chain. It acts as its own small ledger for users to pay for low cost products and services such as music streaming without impacting the layer one Bitcoin network.

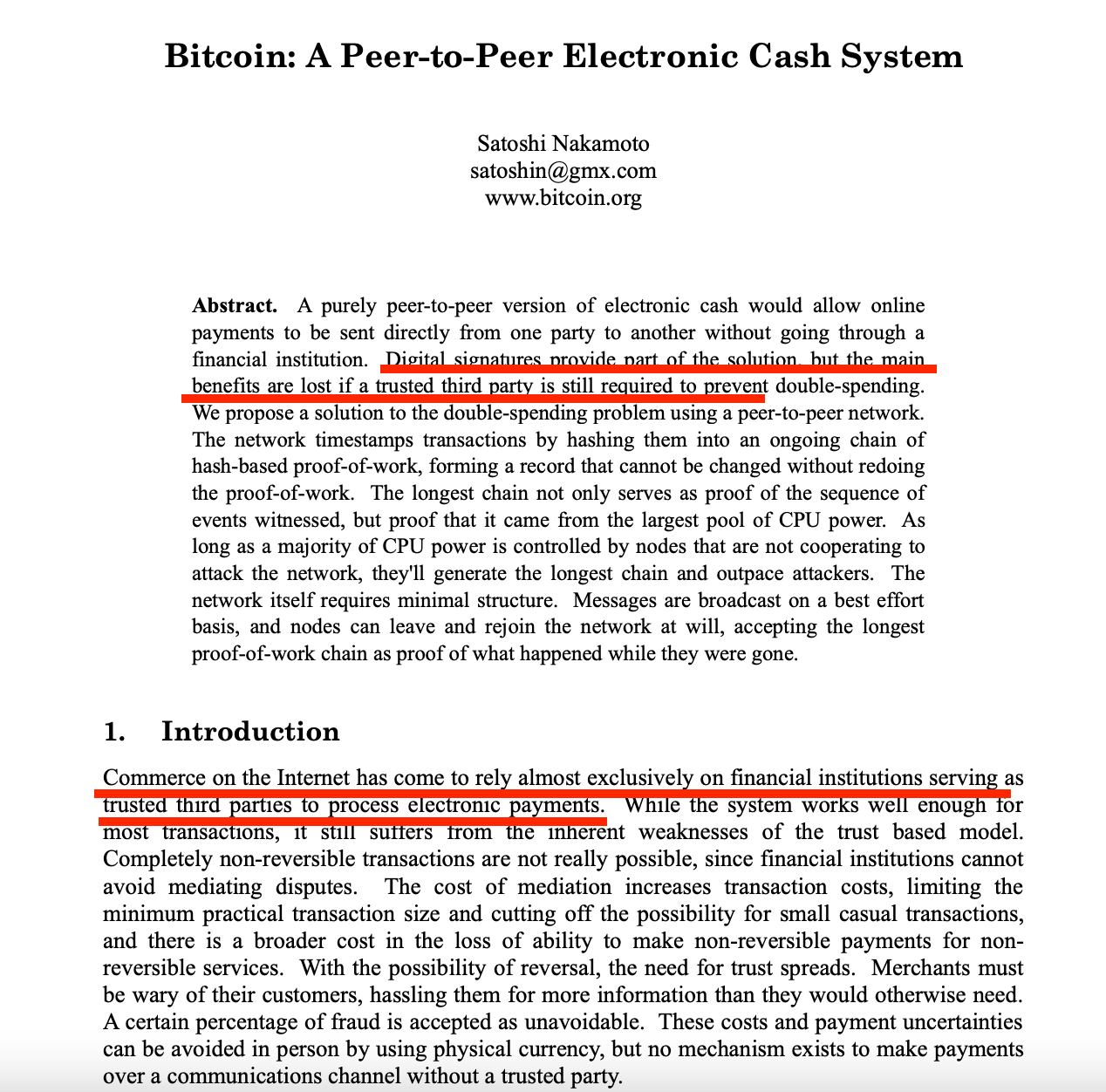

The Lightning Network was proposed in 2015 by two researchers, Thaddeus Dryja and Joseph Poon, in a paper titled “The Bitcoin Lightning Network.” Their writings were based on previous discussions of payment channels made by Satoshi Nakamoto, the anonymous creator of Bitcoin. Nakamoto described payment channels to fellow developer Mike Hearn, who published the conversations in 2013.

Total value locked in Bitcoin lightning network reached 4,853 BTC which at the time was value around $1.3 billion. The Lightning Network is growing as more companies use it to make payments happen. The number of bitcoins locked in the Lightning Network (LN) has tripled from 1089 BTC in 2021 to 4,853 BTC in January 2024. El Salvador’s adoption of Bitcoin has seen 15,000 new nodes added to the network. Bitcoin wallet and payments provider Strike’s partnership with the government of El Salvador caused the network’s capacity to increase by 46% two months after the partnership was announced.

With the Bitcoin ETFs (Exchange Traded Funds) in the first three days of trading, investors poured approximately $1.9 billion. This level of initial investment outpaced the early inflows of previous ETFs like the ProShares Bitcoin Strategy ETF and the SPDR Gold Shares ETF. The new Bitcoin ETFs have attracted significant amounts from large asset managers such as BlackRock and Fidelity.

We envision a future where skilled operators and administrators of the Bitcoin Lightning Network will offer node management services. This expertise will enable financial institutions to effectively utilize Bitcoin and other digital assets, creating opportunities to generate yield.

Node Channels

“If the internet gets a chance to get a native currency, what will that be? To me, that’s Bitcoin because of those principles, because of that creation story, because of its resilience”…”Bitcoin Lightning Network for Twitter is just a matter of time…”

Jack Dorsey, Founder and ex-CEO of Twitter and Block formerly Square a payment solutions provider

Liquidity Providers

If you would like to establish a channel with our Royalty Finance Bitcoin Lightning node or to receive liquidity.

For any questions related to node creation, administration and general operations.